Re: Licensed Customs Brokers – External Consultation – Customs Act 1901 – Section 183CGA

Submission from:

Platinum Freight Management Pty Ltd, a Licensed Corporate Customs Brokerage [LCCB] since 2000 and Peter McRae, a Licensed Customs Broker [LCB] since 1998 [qualifications are listed at the end of this submission].

The ABF has already placed eight [8] conditions on Licensed Customs Brokers and are considering to place an additional ten [10] conditions on LCB’s. This equates to a 125 percent increase in licensing conditions upon LCB’s.

The licensing year is about to commence on 01 July 2023. It would be extremely inconsiderate, short-sighted and rushed on the part of the ABF to expect these proposed conditions to be implemented within two months; external consultation involves more than two months of consultation.

Whenever future conditions are being considered to be implemented on a regulated industry; one would expect that risk’s were analysed against a risk assessment process and not just a ‘tick and flick’ process of 1) copying and pasting conditions from high risk categories within the importing process [such as Customs depots [s77G] and Customs warehouses [s79] and / or 2) some person within the ABF attempting to show how clever they can be to their superiors.

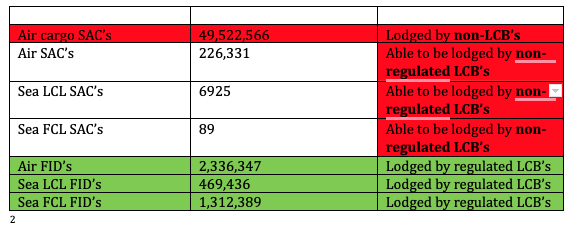

The current communication of imports in the Australian landscape involves the following non-LCB’s and LCB’s communicating to the ABF.

The ABF allows in excess of 49,000,000 air cargo report – Self Assessed Clearances [SAC’s] to be communicated to the ABF by non LCB’s; this is compounded by the fact that the ABF does not truly know the importers name, address, telephone number or photo identification details.

The ABF allows in excess of 230,000 Self Assessed Clearances to be communicated to the ABF by possible non-LCB’s; this is compounded by the fact that the ABF does not truly know the importers name, address, telephone number or photo identification details.

The ABF allows air cargo report SAC’s to be communicated to the ABF by non- LCB’S. These persons are not subject to any licensing conditions.

The ABF allows SAC’s to be communicated to the ABF by non-LCB’S. These persons are not subject to any licensing conditions.

Current conditions:

[1] The holder of a customs broker licence must, when requested by the Department of Home Affairs (the Department), complete and forward the required documentation to allow the Department to undertake a fit and proper person check on the licence holder.

The ABF have advised that there are no proposed changes. We agree.

[2] In the case of a customs broker licence held by a company; if there is a change in the director, officer, shareholder or member of the company the holder of the licence must, within 30 days after the occurrence of the event, notify the Comptroller-General of Customs of that event.

The ABF have advised that they are considering to reduce the time required to advise the ABF of these changes to say 7 or 14 days.

We believe that as the ABF granted the initial Licensed Corporate Customs Brokerage licence to the LCCB; based on the structure of the business at the time of application and subsequent approval, that the LCCB should advise the ABF of any changes on the same day that the change was submitted to the Australian Securities & Investments Commission [ASIC].

[3] A director, officer, shareholder or member of a licensed company must, when requested by the Department, complete and forward the required documentation to allow the Department to undertake a fit and proper person check on that person.

The ABF have advised that there are no proposed changes.

We agree.

[4] If a holder of a customs broker licence becomes aware that information that has been provided to the Department is false, misleading or incomplete, the customs broker must, as soon as practicable and always within 24 hours after becoming aware provide written particulars of the incident to the Comptroller- General of Customs.

The ABF have advised that they are considering to include ‘and always within 24 hours’ into the current condition.

We believe that this proposed amendment is not practical nor essential. The proposed amendment is essentially requesting LCB’s to communicate with the ABF after hours, on weekends, public holidays, during annual, maternal or paternal leave.

The LCB would in the usual course of business [once they have become aware that the information is false, misleading or incomplete [wish to confirm their thoughts with 1) their employer, 2) the importer, 3) the supplier and / or 4) possibly their Professional Indemnity Insurer [PII]. We do not believe that this condition needs to be ‘escalated’

[5] The holder of a customs broker licence must not allow Departmental systems or information provided by the Department to be used for any unauthorised purpose or to assist, aid, facilitate or participate in any unlawful or illegal activity.

The ABF have advised that there are no proposed changes.

We agree – however – we believe that the ABF should be reminded that LCB’s are not the only persons that have access to the ICS. The ICS is currently accessible to non-LCB’s who are not placed under this condition.

[6] A natural person who holds a customs broker licence must undertake accredited Continuing Professional Development (CPD) as per the following requirements: (a) for the purposes of this condition, accredited CPD activities are the activities accredited by the Comptroller-General of Customs or by a CPD provider that has been granted Accredited CPD Provider status by the Department. A customs broker must complete sufficient accredited CPD activities, as detailed on the Australian Border Force (ABF) website, to acquire the minimum number of points each CPD year, which commences on 1 April each year and ends 31 March the following year. (b) the holder of the customs broker licence must keep accurate, auditable, written records of completion of accredited CPD activities and provide them upon request to the Comptroller- General of Customs. (c) the holder of a customs broker licence must notify the Comptroller General of Customs if the holder of the customs broker licence has failed to complete the required number of points and provide a written explanation of the circumstances surrounding the failure prior to the end of the CPD year.

The ABF have advised that there are no proposed changes.

We agree – however – the number of points required should be mentioned on the LCB’s licence.

[7] The holder of a customs broker licence must not lodge import declarations from outside Australia.

The ABF have advised that there are no proposed changes. We do not agree with this condition.

There are currently 1620 LCB’s in Australia; this number is made up of sole traders and LCB’s. Some may say that the number of LCB’s are decreasing. The ABF currently place eight [8] conditions on LCB’s and there are ten [10] proposed additions [a 125 per cent increase in conditions]. LCB’s are required to lodge Full Import Declarations [FID’s].

The ABF must be aware that LCB’s submit approximately:

2,336,347 air FID’s and approximately 1,781,825 sea FID’s. The ABF must also be aware that approximately 49,000,000 air cargo report SAC’s are being communicated to the ABF by non-LCB’s and 233,345 SAC’s are being communicated to the ABF by persons who are not required to be LCB’s. Non- LCB’s are not required to be licensed nor are they required to be bound by the current eight conditions nor the proposed ten additional conditions.

We find it very dysfunctional that the ABF does not / has not assessed the amount of SAC’s that are lodged by non-LCB’s to be considered as high risk. The customs entries that LCB’s submit to the ABF are low risk compared to the amount of SAC’s that are submitted by non-LCB’s.

We believe that LCB’s should be the only persons who submit any customs import declaration to the ABF [not including air cargo report SAC’s]. A LCB understands such things as price, price related costs, commissions, additions and deductions.

We believe that LCB’s should be able to, should be permitted to and should be granted 30 calendar days in one calendar year to take annual leave and to lodge import declarations whilst overseas. We would expect that the LCB would provide the ABF with their e-ticket, date of departure and date of return and that the ABF list a special note on the LCB’s file that they have this permission.

The risk of having a LCB lodging importing declarations overseas [while on annual leave] is minimal. A LCB has achieved their licence and continues to maintain their licence; why would they be considered a high risk by the ABF?

The ABF have more issues with Customs depots [s77G] and Customs warehouses [s79] than they do with LCB’s

This condition is 1) archaic and 2) was implemented at a different time than what a LCB’s life is like in 2023.

[8] The holder of a corporate customs broker licence must maintain suitable professional indemnity and public liability insurance for the protection of their clients and the Commonwealth. The licence holder must forward evidence of insurance to the Comptroller-General of Customs if requested.

The ABF have advised that they are considering to include ‘and public liability’ to the current condition.

We do not agree with this proposed condition.

The purpose of Public Liability Insurance [PLI] is to cover you for third party death or injury3. A LCCB already holds Professional Indemnity Insurance [PII], there is no need to also hold PLI. This condition would be more suited to Customs depots [s77G] and Customs warehouses [s79].

Proposed – additional conditions

[1] A customs broker must undertake due diligence and take reasonable steps to ensure all information declared/provided to the ABF is accurate and correct. This includes, but not limited to, information related to classification, valuation and confirming that goods meet all conditions of any concessions prior to claiming a concession.

We find this proposed condition micro-managing from the part of the ABF.

A LCB already does what this proposed condition states. Why does the obvious need to be stated as a condition on a LCB licence?

We find this proposed condition dysfunctional from the part of the ABF.

The ABF does minimal to educate LCB’s in the area of valuation; the ABF should publish regular valuation manuals, valuation cases/scenarios and policy guidelines. Countries like Canada publish regular and detailed updates to their LCB’s.

The ABF does minimal to educate LCB’s in the area of classifcation; the ABF should publish regular classification rulings, classification manuals, classification cases/scenarios and policy guidelines. Countries like Canada, the United States of America and the European Union publish regular and detailed updates in regards to classification rulings; the ABF should make public their classification rulings for LCB’s.

Why should tariff classification rulings be behind closed doors? This does not educate the industry nor LCB’S.

Why should the whole of industry need to file individual tariff classification ruling applications for the same goods in order to receive the same answer?

[2] A customs broker must undertake due diligence and take reasonable steps to verify the identity of their client. At a minimum a customs broker must obtain and retain two forms of identification, including a government issued identity document that contains a colour photo.

We find this proposed condition micro-managing from the part of the ABF.

LCB’s who are proficient at their role already ask for one piece of photo identification]. Asking for two pieces of identification is unnecessary. Asking for a colour photograph piece of identification is unnecessary; some forms of identification are sent by fax or email and when printed are black and white.

Some importers [the minority] do not have photo identification. Some importers who are elderly, don’t drive and don’t have a passport – would not be able to satisfy this condition. Not all importers have a colour scanner. Sometimes photo identification is photocopied at a library [black and white] and posted.

[3] A customs broker must not disclose the operational details of container holds. This includes details that are assumed or deduced via the knowledge or experience of the customs broker in relation to x-ray holds, ABF examinations etc.

If an importer’s goods are placed under ‘Border Hold’ a LCB does not know why the cargo is placed under border hold and also the LCB does not know what is occurring behind the scenes.

It is standard practice for the LCB to email Cargo Support and then receive an email in return to say that the cargo is under border hold and then the LCB has something to show the importer.

[4] The licensee must at all times comply with the terms and conditions of accessing the Department of Home Affair’s Integrated Cargo System (ICS). URL to be provided.

We find this proposed condition micro-managing from the part of the ABF.

On each occasion that a LCB accesses the ICS, they are already required to acknowledge this question ‘Do you agree to be bound by the terms of the CCF User Agreement?’

[5] A customs broker must not modify/alter documents related to a customs declaration without authority, a legitimate reason for doing so, or without explicit authority from an Officer of the ABF.

We find this proposed condition micro-managing from the part of the ABF. We find this proposed condition not necessary as LCB’s do not have a reason to modify/alter documents. LCB’s act as agents to the importer.

[6] Mimic the Fit and Proper Persons licence condition placed on Depots and Warehouses, refer to ACN 2022-46 for full details. All staff who work in the ‘operations of a brokerage’ must be fit and proper. Within seven days of commencing to participate in any of the operations of the licensed place, employees must complete a Declaration that: a. the person has not been convicted of an offence against a law of the Commonwealth, or of a State of Territory, or of any other country or part of a country; b. the person has not been refused a transport security identification card (as defined in section 4 of the Customs Act 1901), or has had such a card suspended or cancelled; c. if the person is not an Australian citizen, the person has not breached any condition of their visa to reside in Australia; and the person is not an unlawful non-citizen.

The opening sentence of this proposed condition shows that the ABF are attempting to place LCB’s and Customs warehouses [s79] and Customs depots [s77G] into the same ‘basket’ LCB’s are not Customs warehouse [s79] nor are they Customs depots [s77G].

After reading the ABF’s regular Good Compliance Updates4; it always appears that the ABF has more issues with Customs depots [s77G] and Customs warehouses [s79] versus LCB’s

It also appears that the ABF is attempting to make a LCB’s place of employment a ‘secure area’ or a ‘restricted area’ and that all persons that visit or work at that address will need to be ‘screened’ We find this proposed condition micro- managing from the part of the ABF.

Why should all employees be subject to ‘screening’ The ABF should risk assess the LCB, the LCCB, the Customs depot [s77G], the Customs warehouse [s79] but not the accounts, sales, marketing, cleaning / maintenance team, Social Media Marketing team nor human resources.

[7] A company or a natural person who hold a customs brokers licence must comply with all acts and laws; including but not limited to; the Customs Act (1901); Customs Regulation (2015), Biosecurity Act (2015)…

We find this proposed conditional micro-managing from the part of the ABF. Firstly, why does the obvious need to be a condition on a LCB licence?

Secondly, ‘all acts and laws….’ does this mean that a LCB must abide by all Acts and laws that are current in the Commonwealth?

[8] The holder of a customs broker licence must act in a manner that demonstrates exemplary professional conduct, including honesty, integrity, and transparency

This proposed condition appears to be micro-managing on the part of the ABF and appears to be a ‘code of ethics’ that the ABF is attempting to place upon LCB’s.

There are defects in this proposed condition as 1) who defines the term exemplary? and 2) who will determine if a LCB has acted exemplary or not?

LCB’s have already passed the test of ethics; they have been screened by the ABF, they have been granted a licence, they do not need to be educated in ethics or religious connotations.

[9] The holder of a customs broker licence must have a risk management plan in place to identify potential border risks in line with the continuing professional development training and take appropriate measures to mitigate them as part of doing business.

This proposed condition appears to be micro-managing on the part of the ABF and also irrelevant.

Whenever a person calls the Australian Border Force [from www.abf.gov.au] for information about importing or exporting; there is a script that the ABF officers

are giving to these persons ‘we can’t assist you, you would be best to speak to a customs broker’

A LCB knows the rules and Regulations in relation to importing or exporting. We do not see the relevance of having a risk management plan in place; LCB’s know how to operate their business and also know to refer suspicious activity to Border Watch.

A LCB would not communicate an import declaration to the ABF without having all of the information in their presence. If the ABF believes that there are LCB’s who actively communicate import declarations to the ABF without all of the information being present then the ABF should actively consult with that very minute number of LCB’s – but – the whole industry should not be levied with this condition because of a tiny number of LCB’s [if any].

[10] The holder of a customs broker licence must be in possession of all documents required, as per the relevant and applicable legislation and any other Australian border agency import conditions, prior to lodgement of a declaration to the ABF.

This proposed condition appears to be micro-managing on the part of the ABF and also irrelevant. A LCB would not communicate an import declaration to the ABF without having all of the information in their presence. If the ABF believes that there are LCB’s who actively communicate import declarations to the ABF without all of the information being present then the ABF should actively consult with that very minute number of LCB’s – but – the whole industry should not be levied with this condition because of a tiny number of LCB’s [if any].

Improvements:

1} We would like to see the ABF regulate that LCB’s are the only persons who can communicate SAC’s to the ABF.

- We would like to see the ABF publish more regular and detailed practice statements, policy manuals, tariff classification rulings, valuation procedures, transfer pricing manuals, practice statements and customs broker updates [possibly in a secure site – only accessible to LCB’s].

We believe that there should be a two tier LCB licensing system for LCB’s; there should be 1) a learner/provisionary licence and a 2) fully We believe that there should be a two tier LCB licensing system for LCB’s; there should be 1) a learner/provisionary licence and a 2) fully accredited LCB.

Conclusion:

It is very dysfunctional for the ABF to consider placing a total of eighteen [18] conditions upon LCB’s when a proper risk assessment has not been conducted.

If the ABF is considered to be the ‘parent’ and the LCB’s are the ‘children’ – then it is up to the ‘parent’ to educate and guide the ‘child’ with the appropriate and required tools to allow them to undertake their work correctly. The ABF have a great deal of ‘gaps’ to fill in regards to providing LCB’s with the tools that they require to continually develop.

If the ABF proceed to implement a total of 18 licence conditions without even providing the ‘tools’ of how, when, where and why – then the ‘parent’ is at fault – not the ‘children’.

Yours sincerely and respectfully,

Peter McRae

Director – Platinum Freight Management Pty Ltd [since 2000] Customs Broker [since 1998]

TAFE NSW – Teacher – Customs Brokering [since 2008] Masters of International Customs Law and Administration Masters of International Revenue Administration Certified Customs Specialist Canada

Certified Trade Compliance Specialist Canada Certified Customs Specialist U.S.A

1 http://safety.unimelb.edu.au/ data/assets/pdf_file/0007/1716712/health-and-safety-risk-assessment-methodology.pdf, accessed 23 April 2023.

2 Freedom of Information requests from the Department of Home Affairs

3 https://business.gov.au/risk-management/insurance/business-insurance

4 https://www.abf.gov.au/importing-exporting-and-manufacturing/trade-and-goods-compliance/goods-compliance-update, accessed 23 April 2023